You should read this guide if you’re an incorporated Canadian physician who:

- expects to have assets in your corporation when you die;

- wants to grow your estate wealth tax-effectively; and

- wants to leave your beneficiaries with minimal problems and the maximum value of your estate possible.

TABLE OF CONTENTS

What does a good estate plan look like?

Executor’s responsibilities for an incorporated physician

Estate planning can overcome a major issue: “double taxation”

Tax-efficient strategies for incorporated physicians

Where should you go from here?

If you are an incorporated physician (or a retired one with a holding company), estate planning is more complex than for other physicians. Without the right strategies in place, your estate could end up paying much more tax than necessary, leaving less for your beneficiaries.

What is estate planning?

You’ve worked hard to build your wealth, so naturally you want to decide how it’s distributed. Estate planning involves deciding who will benefit from your estate and how. But there’s more to it than that.

Estate planning includes protecting your wealth during your life. It also involves implementing smart planning strategies during your working years.

Estate planning also considers your own needs during your life and balancing those with the legacy you want to leave.

What does a good estate plan look like?

A proper estate plan:

- ensures that your assets pass to the heirs of your choice

- facilitates efficient administration of your estate, including your corporation

- ensures that all the significant tax events at your death and afterward are well managed

- ensures that distribution of your assets before and after death is tax-effective

- avoids leaving beneficiaries with assets or issues they don’t have the capacity to manage

- ensures that, during your life, your estate wealth is grown in a tax-effective way

- provides a plan for managing your finances should you become incapacitated

The role of an executor

As an incorporated physician, you have to assume that settling your estate will be a complex undertaking. There will be important and time-sensitive tasks to fulfill.

Your executor must have the time — as well as the knowledge of business, tax and estate laws — to manage your estate and the corporation you’re leaving behind. The executor should be a Canadian citizen and not have any conflicts of interest that may interfere with the process.

Still, the competing priorities of managing your estate and making decisions about your corporation can be overwhelming for an executor — and can result in inefficiencies and costly delays. Your executor could also be personally liable for their actions.

A professional executor may be the best choice for you.

The professionals at MD Private Trust Company regularly work with incorporated physicians to manage these demands and complexities.

Executor’s responsibilities for an incorporated physician

Settling an estate is much more complex when there is a medical professional corporation or holding company to deal with.

Keep in mind that in your will, you can address what happens to your shares in the corporation but not what happens to the corporation itself. If you were the only director of your corporation, your executor will have to appoint a new director.

Together, the director and the executor will evaluate the corporate assets and your estate plan, and decide whether to continue or wind up the corporation. If the corporation is continued, the new director will take responsibility for the corporation going forward, and your shares will be distributed in kind to your beneficiaries.

The main responsibilities of an executor for an incorporated physician include:

- safeguarding all important documents and locating, securing and appraising all assets

- collecting any income owing and paying all debts

- making tax elections and filing tax returns (personal and estate)

- properly storing patient medical files

- notifying patients and closing the practice

- settling any claims against the estate and making the distribution to beneficiaries

- appointing a new director for the corporation

- with the director, making the decision about incorporation:

- evaluating the corporation’s assets and the estate plan

- deciding if and when to wind up

- with the director, managing corporate wind-up (if proceeding):

- implementing appropriate tax strategies

- ensuring distribution of corporate proceeds to shareholders

Estate planning can overcome a major issue: “double taxation”

Most of us accept that taxes are necessary, but we don’t want to pay more than our fair share. Of course, taxes can never be avoided completely, but good estate planning can reduce the amount your estate must pay.

The possibility of double taxation is a significant issue that many incorporated physicians look to take care of in their estate plan.

When you (as an incorporated physician) die, there is one immediate level of tax on your shares. That’s because on your death, you are considered to have disposed of your corporation’s shares at their fair market value. This often results in a taxable capital gain that’s reported on your final personal income tax return.

Then, there is a second level of tax — this one on distributions from the corporation. Typically, that’s when the director sells your corporation’s appreciated assets, pays any corporate liabilities and distributes the net cash to your estate in the form of dividends. This is part of winding up the corporation.

With double taxation, you are essentially paying tax twice on the value of your corporation. However, with good estate planning and administration, one level of tax can be recouped.

Example

Let’s say that when you die, your shares in your corporation are worth $2 million. Without a proper estate plan in place, these shares could, in a worst-case scenario, be subject to taxes as high as about 72%, or about $1.45 million. That’s an inefficient legacy that you’d want to avoid for the sake of your beneficiaries.

Now, let’s assume your estate plan contemplated tax-efficient strategies for your corporation. To that end, in your will you’ve given your executor all the powers and discretion necessary to deal with your assets, in cooperation with the new corporate director, as tax-efficiently as possible. Your executor knows that if the wind-up is done within a year of your death, the original capital gains tax may be recovered.

By properly managing just this one aspect of your estate, your executor reduces the total taxes associated with the value of your corporation to about $950,000.

| Corporate shares | No estate plan | Estate plan |

|---|---|---|

| Value at death | $2,000,000 | $2,000,000 |

| Taxes | ($1,450,000) | ($950,000) |

| After-tax value of shares | $550,000 | $1,050,000 |

At MD Financial Management, we encourage incorporated physicians to provide their executor with broad discretion to implement post-mortem corporate and estate tax-planning strategies. These complexities often call for professional help from an MD Private Trust Company Estate and Trust Advisor, a Scotia Wealth Insurance Services Insurance Consultant and your tax specialist or accountant.

Tax-efficient strategies for incorporated physicians

While you and your MD Advisor* may consider many different estate planning strategies that suit your unique circumstances, here are some common ones that can be used to manage the tax impact on your estate.

Strategy 1: Using your corporation to make the most of charitable bequests

When you die, your assets are distributed according to your will. There are some smart distribution strategies that reduce the tax on your estate. One example is making charitable donations from your corporation.

A corporate donation of qualified investments (e.g., stocks or mutual funds) can result in a triple benefit to the corporation:

- There will be a deduction from corporate taxable income based on the full value of the qualified investments donated.

- There will be no capital gains tax on any accrued capital gain in the donated investment (as would have been the case if the investment had been sold and its proceeds donated).

- The corporation will benefit from a credit to its notional capital dividend account, increasing the amount of tax-free capital dividends the corporation can pay to its shareholders.

Strategy 2: Using your TFSA to manage investment growth

From a tax perspective, tax-free savings accounts (TFSAs) are good for you and they’re good for your beneficiaries.

Generally, incorporated physicians should be maximizing their TFSA contributions. Although TFSA contributions are made with after-tax dollars, all future growth is tax-free. So over the long-term, the TFSA is typically a better investment vehicle than leaving the funds in an investment account in your corporation — especially if the corporation is generating surplus investment income and/or reducing your access to the small business tax rate.

When it comes to your estate, the benefit of a TFSA is that those funds can be left to your beneficiaries tax-free. You can pay yourself from your corporation and contribute the funds to your TFSA until any age (unlike an RRSP, which is capped the year you turn 71).

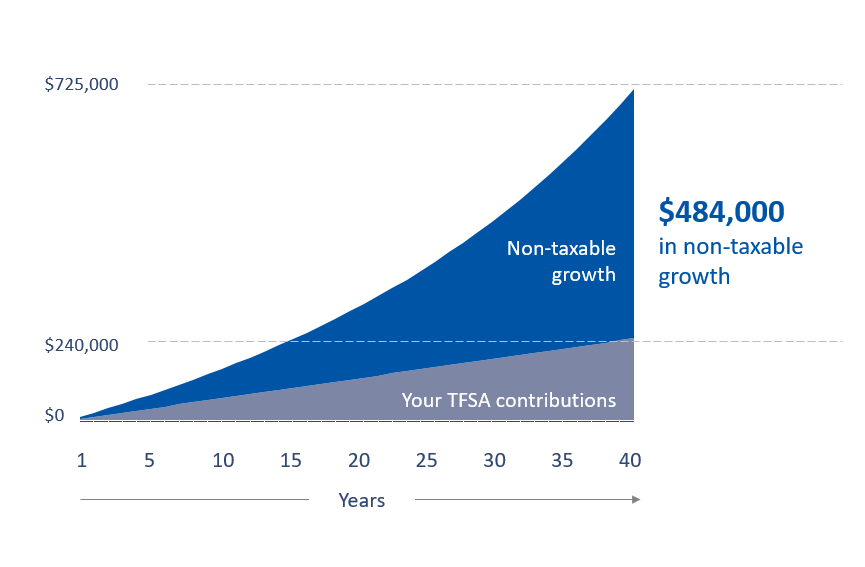

To illustrate the tax savings, let’s say you contributed $6,000 a year to your TFSA for 40 years, for total contributions of $240,000.

If we assume annual growth of 5%, the account would actually be worth $724,800. And 67% of that —around $484,000 — is non-taxable investment growth.

Strategy 3: Rolling over shares to a spouse or partner

This strategy is something that would be stipulated in your will. If your corporation is wound up on your death, this generally means your shares must be redeemed or sold back to the corporation.

Another option is to transfer your shares in the corporation to your spouse or common-law partner. Known as a “rollover,” it is a way of deferring capital gains tax at death.

This strategy postpones the calculation of the capital gain and any resulting tax owing until the spouse sells the assets or until they die. The shares can be transferred to your spouse or to a qualified spousal trust that is set up in your will. Remember that this rollover strategy defers taxes, but it won’t eliminate taxes.

Strategy 4: Buying permanent life insurance through your corporation

A corporate-owned permanent life insurance policy is a popular estate planning tool for incorporated physicians. During your life, you can build assets tax-free in the investment component of the insurance policy.

Growth on the investment component is tax-exempt while the investments remain in the policy — and this serves to increase the death benefit amount. On your death, your corporation (as the designated beneficiary) receives the death benefit tax-free. The death benefit, less the policy’s adjusted cost basis, is a credit to the corporation’s notional capital dividend account, which means the corporation can pay a capital dividend tax-free to your estate (or your heirs if they were also shareholders).

You may want to plan for the proceeds from the corporate-owned insurance to pay the taxes owing on your final personal income tax return. Alternatively, you can leave it to your heirs to decide what is best.

Strategy 5: Using an estate freeze

An estate freeze is a strategy you can implement during your life to reduce or defer taxes in your estate. This strategy freezes the value of your shares in the corporation at a certain point in time, effectively capping the amount of capital gain on them.

Once the freeze is in place, you will know and can plan for the income tax that those shares will likely trigger with your death. As part of the estate freeze, your beneficiaries can subscribe for(agree to own) shares of the corporation, and any further growth in the corporation from that point forward will accrue to your beneficiaries. This may create an opportunity to leave the corporation operating after your death if that’s what fits best with your overall estate plan.

More points to ponder

As you consider the estate planning strategies presented in this guide, bear in mind these additional considerations:

Don’t forget to plan for incapacity

An often overlooked aspect of estate planning is developing a plan in case you (and/or your spouse) become incapacitated through illness (e.g., dementia) or an accident. A plan provides you with financial independence, as well as control over how your assets are managed and how they’re spent on you and your care when you may not be able to make such decisions yourself. Depending upon your age and circumstances, your plan for incapacity can take many forms, such as a continuing power of attorney or an inter vivos trust.

Retirement can be busy

For many physicians, retirement is a transition from a busy practice to a full calendar of retirement activities. You may find that you have less free time than you imagined for managing your affairs. This is especially true if your health declines during your “golden years.” If your advisors present you with different corporate tax strategies and other tax-saving transactions, be aware that some will demand considerable time and effort on your part. Be sure to take on only what you reasonably can.

Corporate wealth and complexity

If you have significant assets — especially corporate assets that are clearly beyond your personal needs — be aware that estate planning will be even more complex for you than for the average incorporated physician. Plus, on your death, there are some complex corporate tax strategies that your executor may want to consider. A professional executor can help ensure efficient estate administration as well as legacy maximization.

Where should you go from here?

Estate planning can be complex for anyone — and even more so for the incorporated physician. Having an efficient legacy is often a matter of smart tax management. There are many pitfalls to avoid and opportunities to know about.

Contact your MD Advisor to find out more about creating an efficient legacy and to ensure you have the right estate plan in place.

* MD Advisor refers to an MD Management Limited Financial Consultant or Investment Advisor (in Quebec), or an MD Private Investment Counsel Portfolio Manager.

All insurance products are sold through Scotia Wealth Insurance Services Inc., an insurance agency and subsidiary of Scotia Capital Inc., a member of the Scotiabank group of companies. When discussing life insurance products, advisors are acting as Insurance Advisors (Financial Security Advisors in Quebec) representing Scotia Wealth Insurance Services Inc.

Estate and trust services are offered through MD Private Trust Company.

An “executor” is called a “liquidator” in the province of Quebec and an “estate trustee” in the province of Ontario. In the province of Quebec, notarial wills do not require probate, whereas the majority of other wills do require probate and are subject to a fixed application fee. All references to probate and probate tax in this document should be read accordingly.

In Canada, a power of attorney can be called a “continuing power of attorney,” “enduring power of attorney” or “protection mandate,” depending on the jurisdiction and the terms contained in the document. A power of attorney for personal care can be called a “representation agreement,” “personal directive,” “enduring power of attorney appointing a personal attorney,” “health care directive,” “advance health care directive” or “protection mandate,” depending on the jurisdiction.

In the province of Quebec, a “power of attorney” is called a “procuration” or a “mandate” and a “continuing power of attorney” is called a “protection mandate.”

The above information should not be construed as offering specific financial, investment, foreign or domestic taxation, legal, accounting or similar professional advice, nor is it intended to replace the advice of independent tax, accounting or legal professionals.