You should read this guide if you’re an incorporated Canadian physician who wants to:

- accelerate your retirement savings beyond the limits of RRSPs, TFSAs and other investment vehicles;

- achieve strong asset growth and tax efficiency; and

- preserve maximum access to the small business tax rate.

Why incorporated physicians need integrated financial strategies

Many physicians incorporate because they want to pay less tax. As an incorporated physician, you can cut the taxes you’re paying on your practice income by as much as 75%, on up to $500,000. The money you save on tax can be invested through your corporation.

When you leave this money in your corporation, you can invest it in various assets such as stocks, bonds and mutual funds. These assets will generate investment income, typically in the form of interest, dividends and capital gains.

This is called “passive income” to distinguish it from practice income or “active business income.”

Here’s the issue: passive income that’s generated in a corporate account is highly taxed. Depending what province or territory you live in, this investment tax can be higher than the top personal marginal income tax rate. What’s more, passive income may even reduce your access to the small business tax rate on your practice income.

If you have a corporation, you will need to manage your corporate investments carefully and integrate these with other financial vehicles to grow your assets. The key is figuring out how to optimize the combination of strategies specific to your situation.

Incorporation and the small business tax rate

One of the biggest financial benefits of incorporating your practice is access to the low small business tax rate on your practice income.

Unincorporated physicians earn their practice income as sole proprietors. This income — after overhead and eligible expenses — is taxed at the physician’s personal tax rate (which can exceed 50% in some provinces), significantly reducing how much money ends up in the physician’s hands.

Incorporated physicians earn their practice income through their corporation. The corporation can pay the physician a salary, and what’s left is taxed at the small business tax rate (about 12% depending on the province or territory). As a result, incorporated physicians have more cash available for investing, paying down business debt and other practice expenses.

How passive income is taxed in a corporation

Passive income does not get the same preferential treatment as practice income, which benefits from the small business tax rate.

In fact, the taxation of passive income can get quite complex. Your corporation pays high tax rates on the investment income (interest, dividends and/or capital gains) it reports each year; and when this money is distributed to you (and other shareholders), it is taxed again.

However, to make sure that the same investment income doesn’t result in both high corporate tax rates and high personal tax rates, some of the corporate tax is refunded to the corporation when dividends are paid.

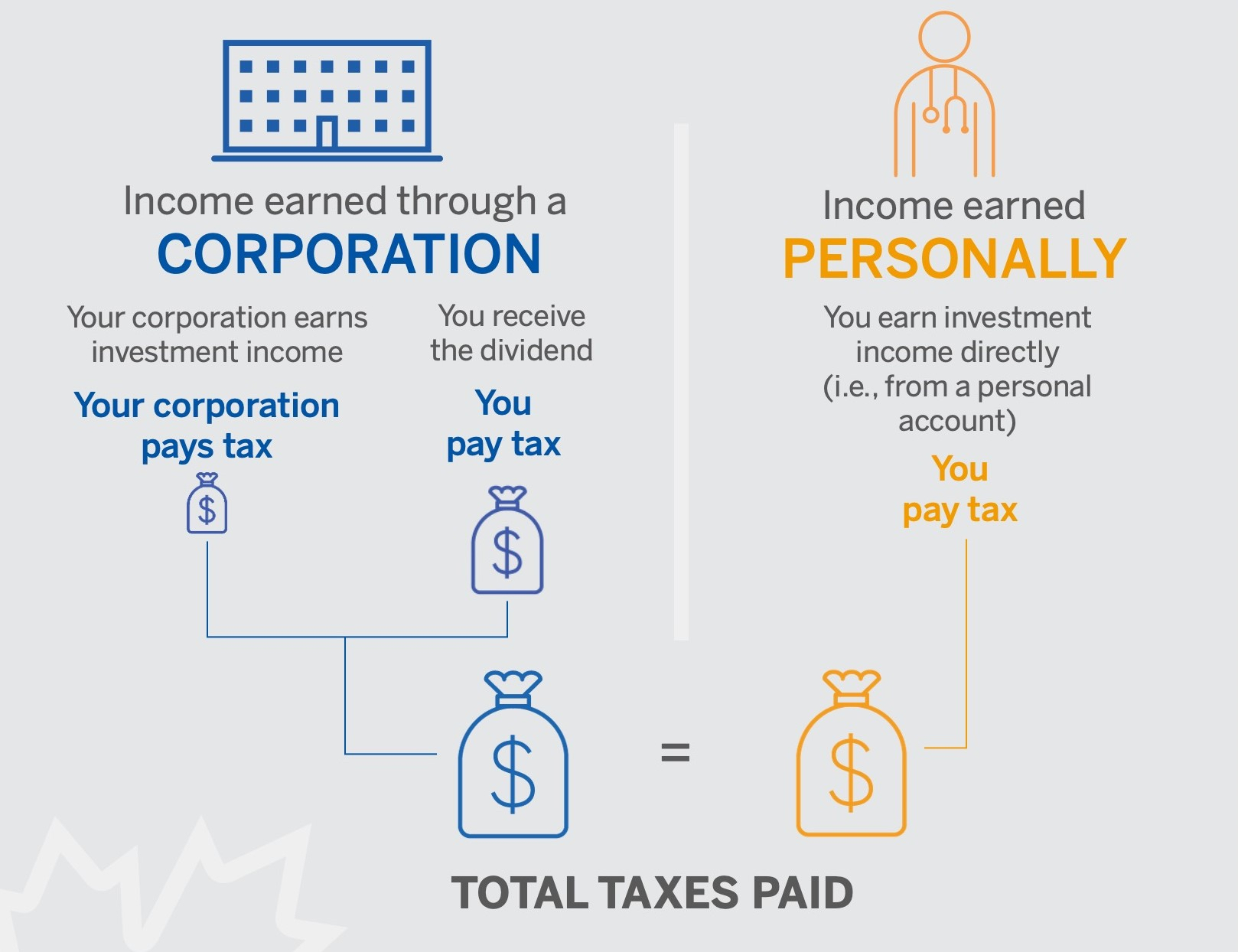

Canada’s tax system uses a concept called tax integration so that, all else being equal, it shouldn’t make a difference whether income is earned personally or through a corporation. The tax should be about the same.

Tax integration keeps it fair

The Income Tax Act (Canada) uses “notional accounts” to help preserve tax integration for corporations.

The three types of notional accounts

- Eligible and non-eligible refundable dividend tax on hand (ERDTOH and NERDTOH)

Corporations often pay tax at the top rate on passive income; however, some of the tax paid on passive income is refundable. When taxable dividends are paid to a shareholder, the corporation is eligible for a refund of this tax. ERDTOH is recoverable through the payment of eligible dividends while NERDTOH is recoverable through the payment of non-eligible dividends. This refundable tax mechanism helps to preserve tax integration. - Capital dividend account (CDA)

Half of realized capital gains earned on an investment are not taxable, regardless of whether this capital gain is earned in a corporation or by an individual. To ensure that the tax-free portion of capital gains earned by a corporation can flow through to shareholders, this non-taxable portion goes into the corporation’s CDA and can be paid out tax-free to shareholders as capital dividends. - General rate income pool (GRIP) Eligible dividends are personally taxed at lower tax rates than non-eligible dividends. Canadian-controlled private corporations, like most professional corporations, can pay eligible dividends to the extent of their GRIP account. Generally, the GRIP is a notional pool that consists of active business income taxed at the basic corporate rate as well as eligible dividend income received by the corporation.

Manage your investments carefully to maximize your assets

By putting the right investments in the right accounts, you can maximize your investment results and achieve stronger asset growth.

Each of the three different types of passive income — interest, eligible dividends and capital gains— has its own tax implications for your corporation and you personally.

Interest is generated from fixed income investments, such as bonds. It is generally the most secure type of income, but also the most highly taxed. Because of this last fact, it makes more sense to hold it in registered accounts like registered retirement savings plans (RRSPs) which provide some tax-sheltering benefits. Holding fixed income investments in a corporate account is not tax-efficient.

Eligible dividends earned in your corporation are attractive because the corporate tax has already been paid by the company issuing them. Personal tax still applies, though, so the benefits of eligible dividends will depend on your personal tax circumstances.

Capital gains only trigger tax when the gain on your investment is realized (i.e., you sell the investment). Realized capital gains have a 50% inclusion, which means only half your capital gains are subject to tax. Capital gains on investments held in a corporation are taxed at a lower rate than eligible dividends.

As a general rule, you should hold relatively more equities — which can generate capital gains — inside your corporation, and relatively more fixed income in registered accounts, where it can be sheltered from the high tax on interest.

If your focus is on growing your investments to provide income in retirement, you are best to focus on investments that generate capital gains, rather than dividends, in order to defer tax. But later in life, when your focus switches to drawing on the funds retained in your corporation, eligible dividends may be more attractive than capital gains.

How passive income affects your access to the small business tax rate

As an incorporated physician, up to $500,000 of your practice earnings is taxed at the low small business tax rate, and the money you save on tax can be invested through your corporation.

The amount you leave in your corporation can be invested in various assets such as stocks, bonds and mutual funds. And, as we saw earlier, these assets will generate passive investment income.

When too much passive income is generated in a corporation, it can result in reduced access to the small business tax rate on your practice income. (Note that this is a federal tax rule, and not all provinces have replicated it at the provincial taxation level.)

How much passive income is too much? For every $1 over $50,000 in passive income you earn in a given year, the amount of practice income eligible for the small business tax rate drops by $5 in the following year.

The practice income exceeding your limit would be taxed at the general corporate rate, which is about 28% (varies by province/territory), compared with the small business tax rate of roughly 12% (also varies by province/territory).

Since incorporating your medical practice allows you to defer tax because of the small business tax rate, many corporate investment strategies are geared to preserving the availability of this low rate.

Your MD Advisor* can help you work out the best combination of investment strategies to control the impact of taxes and thereby grow your net worth.

How compensation decisions affect your taxes

When physicians first incorporate, most pay themselves only a salary from their practice income.

Once their practice income and passive income both reach significant levels, they will generally change their compensation to a mix of salary and dividends. When they retire, it’s common to transition to dividends only.

Since the implementation in 2019 of the passive income rules impacting access to the small business deduction, salary has become more favourable than dividends in many situations. Your MD Advisor and your accountant can help you determine what compensation strategy is best for your situation.

Using your RRSP and TFSA to manage the passive income effect

As we’ve seen, the amount of passive income being earned in your corporation can affect your access to the small business tax rate. Your RRSP and TFSA can help control this effect — and reduce taxes.

RRSP: When you pay yourself a salary (versus dividends) from your corporation, you reduce the amount of active business income in your corporation. The corporation’s active income is a key factor in the passive income rules, and reducing it can mitigate or even eliminate the passive income effect.

With a salary, you also create the ability to contribute to an RRSP. You will get a tax deduction on your contributions, and your investments can grow tax-deferred inside the RRSP, where they aren’t contributing to corporate investment tax challenges. Contributions to a spousal RRSP, where applicable, can split income and further reduce overall taxes.

TFSA: One way to reduce the passive income being earned in your corporation is to take funds out of the corporation— and contribute them to your TFSA. Although you will pay tax upfront to distribute the money from your corporation, there is no tax payable on income generated in your TFSA.

The latter benefit is often greater than the upfront cost (especially in retirement, when that upfront cost will be lower if you are in a lower tax bracket). So generally, it’s smart to maximize your TFSA this way.

Your MD Advisor can analyze your situation and recommend the best investment combination for your goals and circumstances.

Other ways to add value to your corporation

Life insurance: A life insurance policy bought with corporate funds can have several benefits. The lower tax rate applied to those funds makes this a more efficient way to pay for the insurance. If you name the corporation as beneficiary, the death benefit is tax-free to the corporation and could be used to pay your final tax bill, donate to charities, etc. And because corporate-owned permanent life insurance has an investment component, you can use it to transfer excess trapped corporate surplus to your heirs. Access to life insurance depends on your health, with costs increasing as you age, so don’t wait if this strategy applies to you.

Individual pension plan (IPP): IPPs provide a defined benefit pension that’s funded by the corporation but separate from it. This means that income earned in the IPP doesn’t belong to the corporation, so it doesn’t add to passive income and reduce your corporation’s ability to benefit from the small business tax rate. The IPP may allow for higher contributions than an RRSP, as well as pension splitting. The benefits of an IPP need to be weighed against the setup and ongoing actuarial and administration costs.

Banking: There may be advantages to having a banker who is familiar with medical professional corporations. Consider your needs for corporate bank accounts and other corporate banking services, including credit. Business and personal borrowing should generally be kept separate for tax reasons.

More points to ponder

As you consider the asset management strategies and ideas presented here, bear in mind these four points:

Don’t prioritize tax reduction over smart investing

As you’re putting together your investment portfolio, be careful not to let tax issues dictate your decisions. Tax efficiency is an important factor, but your main focus should be on the merits of the investments themselves, and the returns you expect them to generate to help grow your wealth.

Beware of large gains

Watch out for events that end up consolidating passive income. For instance, if you combine two or more accounts from different financial institutions, it could trigger years of accrued gains in certain circumstances. These large capital gains can impact taxes on both your practice income and passive income.

Dividend investing

Be careful when targeting dividend investments, especially prior to retirement. The new passive income rules make dividend income generally less favourable compared to capital gains in corporations. Also, the risks of reducing diversification can outweigh the tax benefits.

Other things to be mindful of

- being associated with more than one corporation

- moving a corporation to another tax jurisdiction

- U.S. person shareholders

- retirement compensation arrangements

Make sure your advisors are aware if you think any of these points might apply to you.

MD helps you achieve greater corporate tax efficiency

The main goal of carefully managing the assets in your corporation is to optimize your corporation’s tax efficiency so you can accelerate your savings and asset growth. There are several proven strategies to consider that can make good use of your corporate assets while preserving access to the very valuable small business tax rate.

Contact your MD Advisor, who will work with you to create and maintain tax-efficient investment portfolios inside your corporation and outside it. An effective asset management strategy can go a long way to helping you build wealth and reach your long-term goals.

* MD Advisor refers to an MD Management Limited Financial Consultant or Investment Advisor (in Quebec), or an MD Private Investment Counsel Portfolio Manager.

Banking and credit products and services are offered by The Bank of Nova Scotia “Scotiabank”. Credit and lending products are subject to credit approval by Scotiabank.

Insurance products are distributed by MD Insurance Agency Limited. All MD employees dealing with clients regarding insurance products hold life licences.

Estate and trust services are offered through MD Private Trust Company.

The above information should not be construed as offering specific financial, investment, foreign or domestic taxation, legal, accounting or similar professional advice, nor is it intended to replace the advice of independent tax, accounting or legal professionals.