Key messages

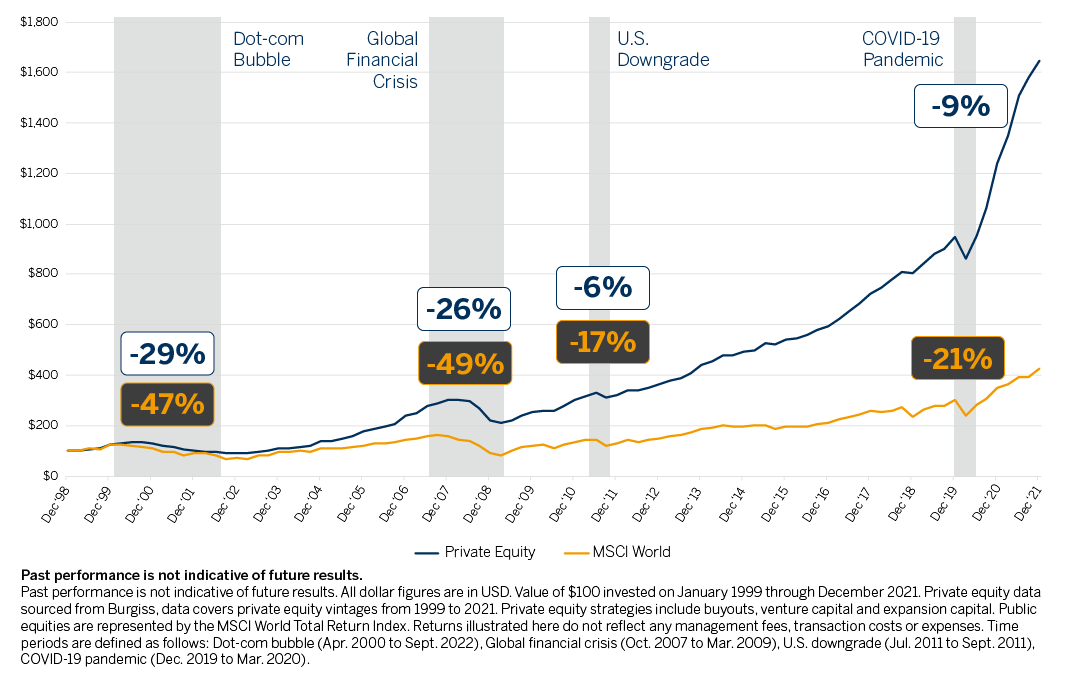

- Historically, private equity outperforms publicly-traded equities during market downturns.

- Private equity may outperform in a low-growth, high-inflation environment.

- The MD Platinum™ Global Private Equity Pool is performing in-line with expectations, generating good performance for investors as of June 30, 2022.

While I can’t predict the state of the global economy with 100% certainty, in the near-term, it’s very likely that interest rates will be higher to combat inflation and economic growth will be lower than what we’ve experienced in recent years (see recent Bank of Canada and U.S. Federal Reserve policy decisions).

Worst case scenario, this can lead to stagflation – an economy that is experiencing higher or rising prices (inflation) and a slowdown in growth (which can lead to more unemployment). What does this potential dilemma mean for stock market investors? Well, slower growth will likely lead to lower revenue and lower earnings growth. Higher interest rates means debt becomes more expensive to service. All this to say that valuations will likely come down.

Privately-owned companies (private equity) vs. publicly-traded companies

In this stagflation scenario, publicly-traded companies (ownership is determined by shares of stock which are traded on an exchange like the S&P/TSX Composite Index or the S&P 500 Index), generally, will have a difficult time. To be fair, privately-owned companies are not immune to stagflation, but the asset class is characterized by a few key elements that can allow it to outperform (relative to publicly-traded stock indices) even in a low-growth, high-interest rate, high inflation environment.

- It can be less risky than the broad market (low beta) – Private equity portfolio managers typically invest in more defensive and less cyclical sectors. For example, the healthcare, consumer staples and technology sectors.

- Expanded toolkit to generate returns – Deep sector expertise, detailed company-level information and private equity specific investment strategies to accelerate revenue generation. For example, buying a company and adding others in the same industry to create synergies and value.

- Access to external funding – A potential safety net during market downturns. For example, during the 2008 financial crisis, new investments and debt issuances were greater for private equity-backed companies without a material increase in leverage due to improvements in profitability and market share.

- Potential innovation – Privately-owned companies continue to have a leading role in innovative technologies that could drive performance. For example, in the areas of decarbonization and alternative energy.

Market shocks on private equity and public indices, January 1999 to December 2021

However, private equity faces its own set of potential risks during turbulent markets. A recession, for example, impacts company buyout dealmaking and the buyout-backed companies themselves. It would also likely put pressure on margins, worsen liquidity, deteriorate credit quality and weaken overall investor demand as well.

MD Platinum™ Global Private Equity Pool update

Activity as of June 30, 2022

| Item | Value |

|---|---|

| Paid-in capital (cumulative amount of capital that has been drawn down) | $65,991,994 |

| Capital distributions | $5,359,029 |

| Ending capital balance | $87,617,921 |

| Total value | $92,976,950 |

When investing in publicly-traded companies, the investor is immediately fully invested. In contrast, private equity managers call for capital that has been committed by investors over time as investment opportunities are identified. Similarly, private equity managers will distribute principal and gains as investments are exited. For these reasons, the timing and size of cashflows in private equity investments are more important.

On June 30th, 2022, the Pool’s internal rate of return declined to 19.98% from 26.07% on March 31,2022. This decline is mostly attributed to two public companies held in the pool – both Rivian and HashiCorp experienced significant declines during the third quarter.

| Investment | Year of original investment | Paid-in capital ($millions) | Value change ($millions) | Total value ($millions) | Total value to paid-in capital | Internal rate of return |

|---|---|---|---|---|---|---|

| Rivian | 2019 | $1.7 | -$3.2 | $3.4 | 1.96x | 35.0% |

| HashiCorp | 2020 | $0.5 | -$0.5 | $0.6 | 1.14x | 6.6% |

| Future Generali India Insurance | 2019 | $1.2 | -$0.4 | $0.1 | 0.07x | -55.6% |

| Advent Global Private Equity IX | 2019 | $2.1 | -$0.4 | $3.9 | 1.87x | 49.1% |

| NEW Asurion Corp. | 2018 | $2.5 | -$0.4 | $3.6 | 1.47x | 11.4% |

Realized investments have created value

As of June 30, 2022, we are still in the early stages with many of our unrealized investments – investments we are actively holding. So, for these investments, performance under 1.0X total value to paid-in capital is normal and not overly meaningful at this time. Most unrealized investments are performing well and are being held at above 1.0X. However, there are a few unrealized investments which have a total value to paid-in capital ratio of less than 0.5X, including Envision Healthcare ($1.4m invested, held at a 0.3X), Latecoere ($0.9m invested, held at a 0.4X) and Future Generali ($1.2m invested, held at a 0.1X).

The total value to paid-in capital ratio is greater than 1.0X on the Pool’s realized investments – a fancy way of saying investments that have been sold. In fact, five investments have been realized at a combined 2.3X total value to paid-in capital with an internal rate of return of 53%.

I look forward to providing future updates. Please note that the MD Platinum™ Global Private Equity Pool is closed to new purchases.

The information contained herein provides key information about the respective MD Platinum™ funds and is not intended to be taken by and should not be taken by any individual recipient as investment advice, a recommendation to buy, hold or sell any security, or an offer to sell or a solicitation of offers to purchase any security. The Platinum funds described in this document are subject to additional terms and conditions set out in the Platinum funds’ operative agreements and regulatory suitability requirements as considered by the MD Private Investment Counsel Portfolio Manager. The Platinum funds’ operative agreements will also set out additional information about the investment objective, terms and conditions of such fund, tax information and risk disclosure that are a material terms regarding a fund. Any investment in a fund would be speculative and would involve significant risks. The information and strategies presented here are not suitable for U.S. persons (citizens, residents or green card holders) or non-residents of Canada, or for situations involving such individuals. Employees of the MD Group of Companies are not authorized to make any determination of a client’s U.S. status or tax filing obligations, whether foreign or domestic. The fund is intended for individuals that are discretionary managed account clients of MD Private Investment Counsel, an operating division of MD Financial Management Inc.

Management fees and expenses associated with investing in MD Platinum private funds may be higher than fees and expenses in public security funds. No guarantee or representation is made that any MD Platinum private investment fund offered will achieve its investment objective.

There are additional risks associated with investing in private investments that are not applicable to typical investments in the public securities markets. These risks include, but are not limited to, the following: private investment funds are speculative and involve a high degree of risk; an investor could lose all or a substantial amount of his or her investment; interests in private equity and private real estate investments are illiquid and there is no secondary market nor is one expected to develop for interests in such investments; there are significant restrictions on transferring private equity and private real estate investments; private equity and private real estate investments experience volatile performance; private equity and private real estate funds are often concentrated and lack diversification and regulatory oversight. Leverage may be employed, which can make investment performance volatile. Real estate investments are sensitive to factors such as changes in real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand and a manager’s skill as well as credit risks and tax and regulatory requirements.

Certain information contained herein constitutes “forward-looking statements.” Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking statements. As a result, the Recipient should not rely on such forward-looking statements. No representation or warranty is made as to future performance or such forward-looking statements.

The information contained in this document is not intended to offer foreign or domestic taxation, legal, accounting or similar professional advice, nor is it intended to replace the advice of independent tax, accounting or legal professionals. Incorporation guidance is limited to asset allocation and integrating corporate entities into financial plans and wealth strategies. Any tax-related information is applicable to Canadian residents only and is in accordance with current Canadian tax law including judicial and administrative interpretation. The information and strategies presented here may not be suitable for U.S. persons (citizens, residents or green card holders) or non-residents of Canada, or for situations involving such individuals.